The top 7 customer success metrics you need to be tracking

One of the best ways to get an idea of how your business is performing (and improve your business performance) is to measure your customer success metrics. Especially in SaaS companies, customer success is essential to a sustainable business model. Too many tracking strategies begin and end with acquisition, with little to no observation of what happens after a sign up.

But understanding your customer’s journey beyond their investment can have a real impact on your team’s strategies, goals, and priorities. Let’s take a look at the importance of customer success metrics for overall business strategy, which ones you should be tracking, and how you can leverage this data to your advantage.

Why you should track your customer success metrics

The connection between your customers’ success and your business' success is clear. When your customers are happy, thriving, and spreading the word about your business, your business will experience growth and prosperity. But more than just knowing whether people are happy and satisfied, you want to dig deeper to understand what they love about your product, what features bring them the most value, and what’s on their wishlist.

This data is not only essential to your success team, but also your product development, marketing, and sales teams. The more you understand your customers, the better you can use that data in every strategy, decision, and priority across your organization. Every team will be aligned around the factors of customer success, and you’ll build both a stronger product offer as well as a more customer-centric workforce.

With the right tools and processes, you can use your customer data for explosive growth. And it all starts with proper tracking.

The top 7 customer success metrics you need to track

There are countless customer success metrics that your business could be tracking, so where do you start? Here are seven key customer success metrics to consider.

1. Customer health score

A customer health score tracks how "healthy" a particular customer is at a specific point in time, and can represent a high-level view of several other KPIs. This score can fluctuate from one week to the next, making it one of the more variable customer success metrics in this list.

A "healthy" customer is happy, using your product regularly, accessing every feature they need, promoting your product to others, and generally poses a low risk of churning. An unhealthy customer, on the other hand, might be facing frustrations with your product, using it less and less, and could be considering switching to a competitor.

Tracking customer health scores is important because it tells your team when to swoop in. It lets them know that this customer needs attention, and it helps pinpoint the kind of attention they need.

2. Customer lifetime value (LTV)

Next is the customer lifetime value (LTV). LTV gives you an idea of how much each customer is worth to your business in the long run, or how much revenue they're likely to bring in over their total time as a customer.

This number is relatively easy to calculate, though benchmarks will vary dramatically from one business to the next. It depends on if you have repeat or one-time customers, how much your product costs, whether you offer subscriptions, if you have a referral program, and so on.

It's critical to know your LTV as it will give you an insight into how many customers you need to maintain growth, whether you're losing money acquiring customers, and if there are opportunities to increase the revenue each customer brings to your business.

3. Customer acquisition cost (CAC)

Going hand-in-hand with customer lifetime value is customer acquisition cost (CAC). CAC refers to the amount you spend to bring a new customer to your business.

This number is crucial, especially concerning your LTV because it lets you know if you're losing money when acquiring new customers. If you're spending $100 to acquire a customer that only provides $50 of LTV, then your prices need to go up and/or your spending down.

To calculate your CAC:

- Look at a period (generally a quarter) and determine how much you spent on marketing, advertising, and any other acquisition efforts.

- Look at the number of customers you brought in during that time.

- Divide your spending by the number of new customers, and you have your CAC. If your CAC is greater than your LTV, it’s time to revisit some things.

4. Customer retention rate (CRR)

Although acquiring new customers is important for every business, keeping customers around for longer is just as (if not more) important. Retaining a customer is almost always more cost-effective than acquiring a new one, it boosts your LTV, and for subscription-based services, it is critical to understanding your performance.

Your customer retention rate (CRR) comes in gives you an idea of how well you're doing at keeping the customers you already have. There are two ways to calculate CRR, and the right one will depend on your business model.

The traditional way of calculating CRR works like this:

- Take the total number of customers you have at the end of a period (one month, year, quarter, etc.)

- Subtract the number of customers you acquired during that period, leaving you with the customers you retained

- Divide this number by the total number of customers you had at the start of that period, and multiply it by 100. The resulting percentage is your CRR.

For a subscription-based company, you can instead choose to divide your total number of active users by your total number of overall users, then multiply that number by 100 to get your CRR percentage. Active users are those that are continuing their subscription. This gives you an idea of how many customers are leaving during each period versus how many are staying.

5. Customer retention cost (CRC)

Your customer retention cost (CRC) pairs with your LTV, CAC, and CRR to give you a clearer picture of your overall customer value, and how it aligns with your customer success efforts. Just like understanding your customer acquisition cost helps you put your acquisition spending into perspective, your customer retention cost helps you put your success and support spending into perspective.

To calculate CRC, take the total cost of your customer success and customer support initiatives and retention strategies and divide that total by your number of active users. Generally, your CRC should be lower than your CAC, but it will depend on your business model and what stage of growth you’re at.

6. Average revenue per user (ARPU)

For subscription-based services, average revenue per user (ARPU) is key to understanding how much revenue each user provides and how many users you need to meet your monthly recurring revenue (MRR) goals (that’s the next KPI on the list!).

You can calculate ARPU by taking your revenue over a period of time and dividing it by the number of active users you had during that period. The result will be your ARPU, which you can then use to project your MRR.

7. Monthly recurring revenue (MRR)

Finally, another metric that subscription services in particular will be interested in is monthly recurring revenue (MRR). For SaaS companies and other subscription providers, this is a vital customer success metric to track.

Your MRR provides insight into your predictable revenue from one month to the next, giving you an idea of your overall success. It's easy to calculate, too. Just take your average revenue per user (ARPU) and multiply it by the average number of customers you have in a month. And that's it!

You can use your MRR as a key indicator of growth, show it to stakeholders, and boost it by improving your other customer success metrics.

Successfully tracking all of your customer success metrics

Knowing which customer success metrics you should be tracking, the next thing you need to get in place is how you're going to track these metrics. The apps and services you rely on today likely already have the data you need to calculate these metrics — but how do you reconcile it in a centralized location, and avoid data silos forming between your customer success team and other teams?

A single source of truth is essential to leading a data-driven business, and leveraging your customer insights towards higher overall performance from every team. When everyone is aligned on KPIs and shares a common understanding of success, you’re more likely to achieve and surpass your goals.

Weld’s all-in-one data platform is built to create a single source of truth for your business data, and bring it into every team’s daily operations. To learn more about how Weld can support your data ambitions, reach out to the team at Weld today.

Continue reading

New Feature - AI Context

Our AI assistant, Ed, now lets you include contexts for your prompt, beyond all the useful features it already had!

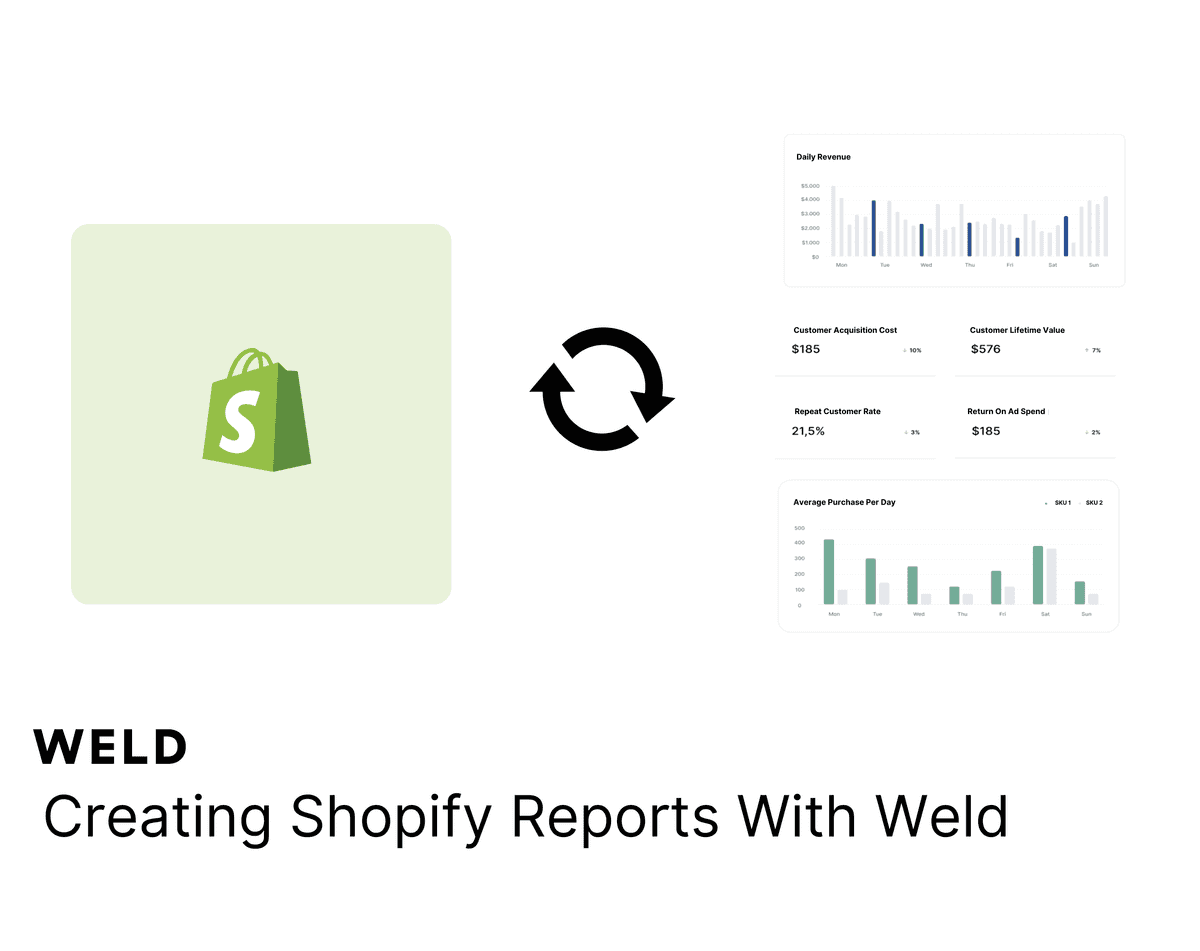

How to set up your Shopify metrics in Weld

Learn how to set up your Shopify metrics in Weld and get actionable insights from your data.

New Connector Alert - Google My Business Profile

Looking to optimize your Google My Business Profile reporting? With our new ETL connector, you can effortlessly integrate your Google My Business Profile data with all your other data sources. Create a comprehensive view of your business metrics, enhance your analytics, and make more informed decisions with ease!