Running a startup can be hard. From growing the team, to raising money, acquiring customers and managing a budget, there are likely hundreds of fires burning at all times.

To help manage these fires (and extinguish some), we’ve compiled a list of the 5 key metrics that every startup should know, and tips on how to measure them. We'll also explore how your business model can affect the way you view your data metrics. Alright, let’s jump in!

What are data metrics and why are they useful?

Data metrics are points of information that give you an idea of how your business is doing. Revenue, for instance, is a basic metric that every business should know. It tells you how much you're earning, which is crucial to measuring your success.

You might also know data metrics by another name: KPIs. KPIs, or key performance indicators, refer to metrics that give you an idea of how well your business is performing.

Data metrics are essential to businesses in the same way that a compass is essential to travel. It tells you where you are and helps you know if you're going where you intend to. It can be a warning sign or a signal to keep going.

5 data metrics for startups

There are nearly infinite metrics that you could be keeping track of at any given time. Most of them, however, are not KPIs and will not give you meaningful insight into how your startup is doing. Below are five metrics that will give you the knowledge you're looking for.

1. LTV

The first data metric is one of the staple customer data insights: LTV. Short for Lifetime Value, LTV gives you an idea of the net earnings a customer will bring to your business over the course of being a patron of your business.

For instance, if your average customer spends $50 at your business and then never returns, then your LTV is $50. On the other hand, if you're a subscription service with customers that stick around for a few months, then calculating your LTV could be more complicated.

The usual method of calculating LTV is to subtract the customer acquisition cost from the total revenue a specific customer brings to your business. Do this for tens or hundreds of customers, depending on the scale of your business, and come up with an average. There are other ways to calculate LTV, but as a rule, this is the way to go.

2. CAC

Speaking of the customer acquisition cost, that's the second metric we recommend you track: CAC. True to its name, CAC is used to estimate how much you spend to acquire a customer.

This can be a difficult metric to calculate as the spending is usually not targeted at a single customer. You could be spending money on various marketing campaigns and channels, targeting various demographics, and acquiring customers from places that are hard to account for, like word of mouth.

Still, this is a vital metric. It's used to calculate other metrics (as we covered in the previous section) and it tells you if you're truly earning a profit. If you spend $100 acquiring a customer and they only spend $50 at your business, you need to know it!

To calculate CAC, you'll need to keep track of the customers you acquire over a specific period of time. Over that same period, you'll need to track your marketing spending. Divide your marketing spending by the total number of customers acquired during that period, and you should have an idea of how much you're spending to acquire each customer.

3. MRR

Third on the list of important customer data insights is MRR. Short for Monthly Recurring Revenue, this data metric clues startups into the revenue they're bringing in every month. This is typically used to track the performance of SaaS and subscription-based businesses, though it can make sense to monitor depending on your sector.

MRR is particularly important because it is predictive. If you have an idea of what you're making each month, then you can estimate future revenue as well. This is key for subscription-based businesses, which have high upfront costs that won't be offset until further in the future.

4. Health score

One of the most important customer data insights is your customer health scores. A health score measures a customer’s engagement and likeliness to chrun. Customers with the highest scores are your most loyal customers, and those with the lowest are your least engaged.

Health scores are one of the best ways to improve your customer retention. It's a well-known fact that retaining a customer is more cost-effective than replacing them with a new customer. Using health scores will help you hold on to your loyal customers and salvage disengaged customers before they churn.

Calculating a health score can be challenging, however. The data you use to calculate it will vary from one business to the next. You may use participation in loyalty programs and engagement with your community, while another organization is exclusively looking at repeat sales. The key, though, is to have the right data at hand to be able to calculate a health score.

5. Churn rate

The last of the customer data insights that you should be tracking is the one that no one wants to talk about: Churn rate. Churn rate is a percentage used to define how many of your customers are leaving your business at any given time.

To calculate your churn rate, look at how many customers you have at the beginning of a period (typically one month) and the number you have at the end of that period. Subtract to find the difference, and divide the difference by the number of customers you started with.

For example, if you started with 100 customers and ended with 90 customers, your churn rate for that month is .1, or 10%.

Although it's standard to measure churn monthly, some opt for quarterly periods (90 days) to avoid counting inactive customers as churned customers.

Also, while churn is inevitable (you'll never be able to retain 100% of your customers) you can use data metrics like health scores to reduce customer attrition. This is one of the key reasons that data is crucial to your startup's success.

How your business model affects your metrics

Now that we've covered the various customer data insights your startup should be tracking, we're going to briefly touch on a few nuanced points to consider. Even though this data is valuable to all businesses, your business model can and should affect how you use your data.

How eCommerce businesses can use metrics

eCommerce businesses are largely B2C and operate by selling goods directly to customers. With that in mind, the most important metrics to use to your advantage will be LTV, CAC, and MRR. This will help you streamline your marketing and invest without overextending your budget.

Using data metrics as an enterprise startup

For enterprise providers, or B2B businesses, your goal is to land and retain large clients as often and as long as possible. That means keeping up with your customer health scores, churn rate, LTV, and CAC.

Data metrics for SaaS and subscription services

Lastly, SaaS and subscription model businesses, which have seen a boom over the last ten years, will want to consider MRR, churn rate, and health scores. Monitoring these customer data insights will help you maximize the value of each of your customers and project future revenue.

Access and activate your customer data insights with Weld

Now that you have an idea of the customer data insights your startup should be using, it's time to put that data to work. Reach out to the team at Weld today and learn how you can make the most of your data.

Continue reading

New Feature - AI Context

Our AI assistant, Ed, now lets you include contexts for your prompt, beyond all the useful features it already had!

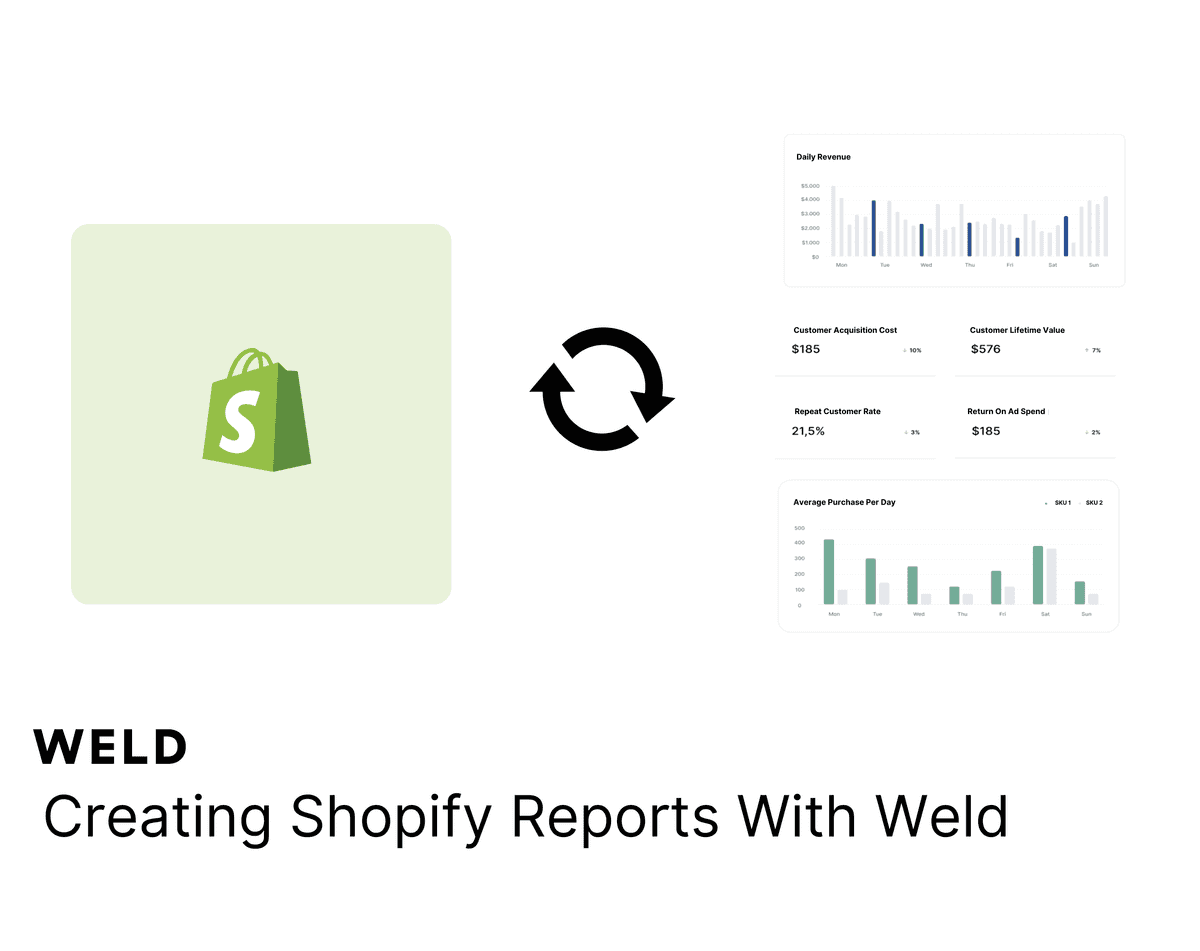

How to set up your Shopify metrics in Weld

Learn how to set up your Shopify metrics in Weld and get actionable insights from your data.

New Connector Alert - Google My Business Profile

Looking to optimize your Google My Business Profile reporting? With our new ETL connector, you can effortlessly integrate your Google My Business Profile data with all your other data sources. Create a comprehensive view of your business metrics, enhance your analytics, and make more informed decisions with ease!